In a significant development for Brazil’s financial landscape, the country’s current account deficit, a key economic indicator, is set for a notable reduction. This positive change is largely attributed to new cryptocurrency regulations and a recent methodological change by the International Monetary Fund (IMF), both of which promise to bring stability and growth to Brazil’s economy.

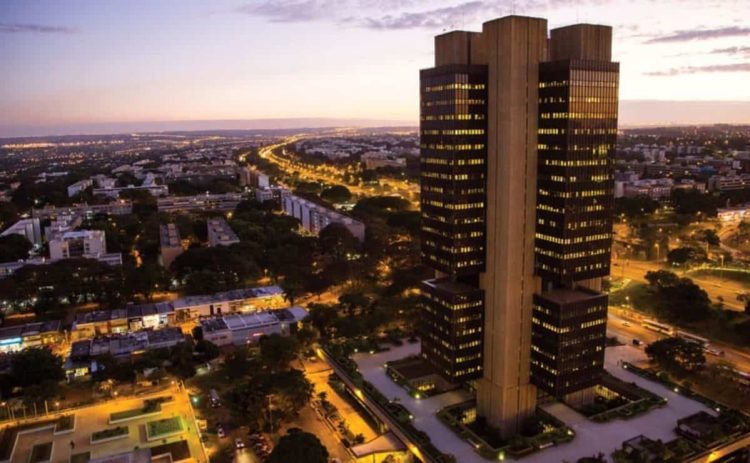

The Brazilian central bank announced that starting next month the purchase of crypto assets will no longer be classified as imports that affect the trade balance. Instead, these transactions will be recorded in the capital account. This change aligns with revised IMF guidelines, which now classify crypto assets as non-financial and non-produced assets rather than goods.

Renato Baldini, deputy director of the bank’s statistics department, highlighted the substantial impact of this review. The 2023 current account deficit is projected to decline from $30.8 billion to $19.1 billion, thanks to the exclusion of $11.7 billion in net imports of cryptoassets from the trade balance. Similarly, the deficit for the January-May period this year will fall from $21.1 billion to $13.8 billion after excluding $7.3 billion in net imports of crypto assets.

This recalibration not only reduces the immediate current account deficit but also integrates cryptocurrency into Brazil’s formal economic structure, improving transparency and attracting foreign investment. The strategic regulatory framework aims to stabilize the financial market, potentially reduce capital outflows and increase the country’s foreign exchange reserves.

The new regulations are expected to attract a wave of investors interested in a regulated and potentially thriving market. This influx of investments and capital inflows will strengthen the national currency and encourage economic innovation. By opening new channels for trade and commerce, Brazil’s broader economic stimulus will support long-term sustainability and growth.

The IMF’s methodological change, which affects the overall balance of payments, ensures that the total balance remains the same by moving crypto asset transactions to the capital account. This account traditionally records low figures, with only $67 million recorded from January to May, but will now include significant crypto asset transactions.

Brazil’s decision to review its cryptocurrency regulations addresses immediate economic concerns such as the current account deficit while laying the foundation for sustained economic health and innovation. As the global financial community watches closely, Brazil is poised to become a leader in regulated cryptocurrency markets, demonstrating a forward-thinking approach to integrating digital assets into its economy.